Understanding Duty Drawback in Shipping

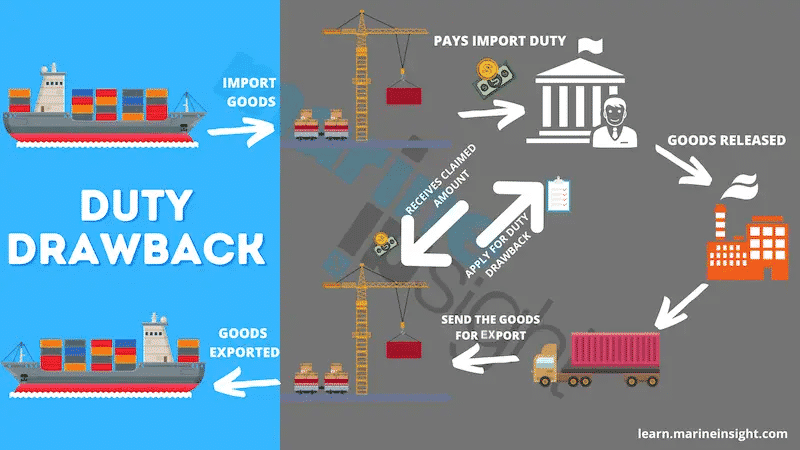

When goods and materials are imported to a country for processing and the finished or processed goods re-exported, the Customs duty that has been paid at the time of the import of the goods and materials can be drawn back from the government. This is generally known as Duty drawback.

The Customs department will issue a credit for the Duty drawback amount to the business after ascertaining that the goods that were imported have been exported and have exited the country.

All of the goods and materials imported may have been exported or it may only be part of the quantity. In this case, the drawback can be claimed only on the exported portion.

Duty drawback can also be claimed for a quantity that has been destroyed under the authority and supervision of the relevant government department.

Why is the Customs duty refunded?

The logic behind refund of Customs duty is that in certain cases, the products that are imported are not consumed in the country of import. Instead, it is used to enhance a locally made product or used as a part of such a product, which is then exported.

Duty drawback is an incentive provided by the government to encourage manufacturing industries in the country. Manufacturing and export are both activities that generate revenue for the government.

The goods that are imported are usually used in the manufacture of goods or processed further within the country. The imported goods or materials that are to be re-exported at a later time should be clearly identified and easily traceable to the exported goods.

At the time of import, they have to be declared and marked to the satisfaction of the clearing Customs officer.

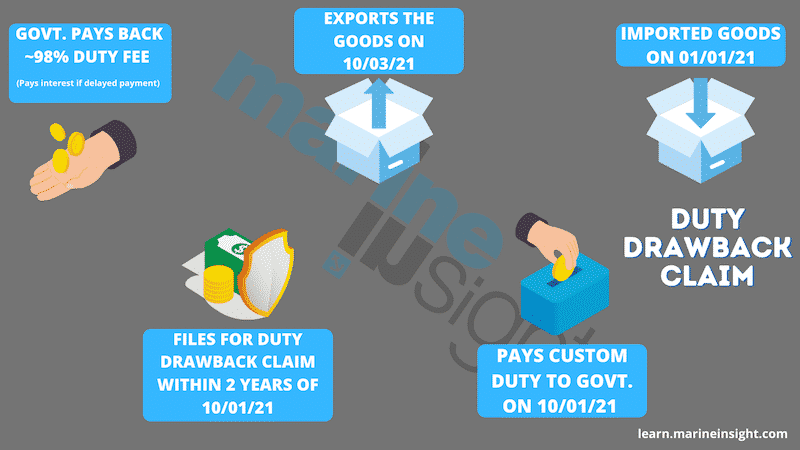

In India, Section 74 of the Customs Act of 1962 allows up to 98% of Duty drawback. The drawback can be claimed on Customs duties on imported goods that are meant for re-export within two years of payment of such import duty.

This period is calculated from the date of payment of import duty and not from the date of importation.

In special cases, after submitting valid reasons for any inordinate delays beyond two years to re-export the goods, the government may allow for Duty drawback. These goods may be exported from the country either in the used or unused state.

Certain goods and materials if they are used after their entry into the country are not eligible for Duty drawback. However, if they are exported subsequently without being used, the drawback can be claimed from the Customs.

Examples of such goods are certain types of apparel, un-exposed photographic films, x-ray, etc.

The rate of drawback is decided by the government taking the duration of use, depreciation value, and other relevant factors into consideration.

When Duty drawbacks are not refunded to the importer/exporter within a specified period, section 75A of the Indian Customs Act provides interest to claimants on these amounts for the period of delay.

In the United States, Duty drawback can be availed on imported duty-paid materials that are used in the manufacturing and processing of goods that are re-exported.

The US Customs and Border Protection also allows Duty drawback on materials that have not been used in any manufacturing but are subsequently exported out of the United States in their unused state.

When goods are imported into the country for processing, the importing business pays import duty to the government. These goods and related documents such as the bill of lading, etc. are identified by the Customs authorities at the time of import.

Once the processing of goods is completed, it is re-exported. Upon re-export, the duty paid on the re-exported portion of the import can be drawn back from the Customs by submitting the relevant forms and documents.

However, it must be borne in mind that the claim on Duty drawback has to be done within a specified period from the date of payment of import duty.

In India, this claim has to be submitted normally within two years. This period can be extended by providing sufficient reasons for the delay in re-export.

When goods are sold to an international customer and shipped to the customer’s foreign location, it is called export.

The question that crops up here is why impose Customs duty at all on import of products and materials that are to be re-exported?

Certain governments have schemes that allow complete Customs Duty exemption to encourage re-export. An Advance license for Duty-exemption is required to avail of such a scheme.

The Advance Duty-exemption license is given to businesses for importing goods that are physically included in products that are meant for export.

Machinery parts, mandatory spare parts, etc. are some examples of items that can be imported through this scheme. However, the imported materials should be traceable to the exported goods.

Arriving at Customs Duty Drawback Rates

How does any government decide the rate of Customs Duty drawback? Are these rates based on the quantities used in the manufacture?

Duty drawback rates are decided on the basis of various technical calculations, estimates, the importance of a specific industry, etc.

It is given on the quantities that are used in the production or manufacture of goods and materials that are later exported.

The main documents (copies) that are normally required for submission to the Customs authorities for claiming Duty drawback are the following:

- Import Shipping bill – The main shipping document issued by the shipping agent.

- Bill of entry – A document filed by the importer to the Customs to enable clearance of goods.

- Import invoice – Invoice of goods showing quantity, description, the rate per piece, total value, etc.

- Duty payment receipt – Receipt for Customs duty paid.

- Export invoice – Invoice of the exporter to the customer located in another country.

- Export packing list – Packing list of cargo showing quantity description and packing of goods.

- Export shipping bill – the main shipping document issued by the shipping agent before export.

Most governments these days have moved to computerized records and data management. Therefore, in such cases, these documents are to be filed electronically through the EDI system (Electronic Data Interchange) also.

Is Duty drawback Used in Trade Protectionism?

At the outset, let us take a quick look at what trade protectionism is all about. It is a country’s trade policy aimed at protecting domestic industries of the country from foreign competition.

There are various tools used to achieve this objective, the important ones among these tools being import quotas, tariffs, and subsidies.

Duty drawback can also be seen as one of the factors that encourage domestic manufacture and trade.

Quotas

Quotas are set by the government to limit imports of certain goods and materials to the country. When imports are restricted the local market will thrive to meet the demand for these goods and materials.

Tariffs

Tariffs are government taxes imposed on certain types of imported goods. When the rates of the tariff are high it deters importers to import these goods. Lesser imports mean more opportunities for local industries to grow and increase their production to meet the market demand.

Subsidies

Subsidies are incentives, financial aid, or other support given by the government to a certain class of industries. Subsidies give such industries an advantage over their competitors, especially foreign competitors. It reduces costs to the producers or manufacturers which is then reflected in the lower cost of goods, giving them a competitive edge.

Duty Drawback and Trade Protectionism

Among these, Duty drawback encourages domestic manufacturing and production that makes use of imported parts or materials.

Since the local industry gets the incentive to get a refund of a part of the Customs duty they have paid on goods and materials, they are encouraged to produce locally and to export. This has a positive impact on a country’s balance of trade.

As we can see in the example given at the end of this article when the Duty drawback percentage fixed by the government is too little, it fails to incentivize manufacturers and exporters, thereby failing to meet its main objective.

Balance of Trade and Influencing Factors

Balance of trade is an economic term that goes by various other names. Some of them are net exports, commercial balance, etc. What is meant by the balance of trade?

In its simplest meaning, it is the difference between a country’s exports and imports, in financial value, over a specific period. The balance of trade is sometimes distinguished between tangible goods and intangible services.

It is normal for the balance of trade to swing between a trade surplus and a trade deficit. These temporary swings may depend on the trade cycle of the country caused by fluctuations in the overall financial value of goods and services produced during a given period also referred to as Gross Domestic Product or GDP.

When the financial value of exports of a country is more than its imports, then the country is said to have a positive trade balance also referred to as a trade surplus.

When it is the other way around i.e., more goods imported to the country than its exports, the country will have a negative trade balance also referred to as a trade deficit.

Various factors influence the balance of trade of a nation.

Availability of raw materials and their costs compared to the availability and cost of these materials in the importing country, cost of production in the exporting country, fluctuation in currency exchange rates, tax, tariffs, trade barriers, and Duty drawbacks are some of them.

Duty Drawback Calculation

Company A is involved in the manufacture and assembly of machines that assist in the cutting of diamonds. Special parts that cost $900 per piece is used in the manufacture of this machinery. These special parts are made by a company in Germany.

When company A imports these machine parts from Germany, they have to pay Customs duty at the rate of 18.4% on the value. When 1,000 pieces are imported, Customs duty will come to $166,000. In this case, the Customs duty will come to $166 per piece.

Company A completes the manufacture and assembly of 1,000 machines. Subsequently, they get export orders from Belgium for 600 machines. So here, Duty drawback can be availed from the government on 600 parts that have now been re-exported to Belgium. The actual Customs duty paid on 600 units works out to $99,600.

If the percentage of Duty drawback fixed by the government is 2.2%, then in the above case, the company can submit a claim for $2,191. This works out to $3.65 per unit.

As you can see here in this example, unless the drawback percentage is fixed logically, it will be seen as too little to incentivize and encourage the industry.

The Goods and Services Tax (GST)

Before the rollout of the Goods and Services Tax (GST) in 2017, the Central Excise duties charged on goods that are produced within the country could be claimed back.

The Central Excise duty known as Central Value Added Tax or CENVAT was a tax on goods that are produced and sold within the country.

Upon providing the necessary documents to show proof of the export of goods, the government would refund the amount as prescribed under Section 75 of the Indian Customs Act of 1962.

The GST has replaced several Central and State indirect taxes. Currently, those exporters who have paid the Integrated Goods and Services Tax (IGST) at the time of exporting their goods can claim a refund from the government.

The process for getting a refund is more or less the same as claiming the Duty drawback except that documents are filed on the government GST portal called ICEGATE (Indian Customs Electronic Commerce Gateway).

Goods and Services Tax has several benefits. It involves technology. All submissions, filings, requests, etc. are done online using the GST portal.

While making the whole process easier it is also considered corruption-free. It lessens the burden of the exporter from having to file hard copies of documents. Goods and Services Tax does away with the system of tax on tax, making it straight-forward and easy to understand.

You might also like to read:

- DDP & DDU Shipping Terms Explained

- What is ETD and ETA in Shipping?

- What is Demurrage and Detention in Shipping?

- Telex Release – Everything You Wanted to Know

- NOTIFY PARTY in Shipping – Everything You Wanted To Know

- What is a Logistics Cycle?

Disclaimer: The authors’ views expressed in this article do not necessarily reflect the views of Marine Insight. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Marine Insight do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader.

The article or images cannot be reproduced, copied, shared or used in any form without the permission of the author and Marine Insight.

Do you have info to share with us ? Suggest a correction

About Author

Hari Menon is a Freelance writer with close to 20 years of professional experience in Logistics, Warehousing, Supply chain, and Contracts administration. An avid fitness freak, and bibliophile, he loves travelling too.

Latest Maritime law Articles You Would Like:

Latest News

- What are Logistics Risks?

- How Port and Terminal Operators Can Control Emissions?

- Minimum Quantity Commitment (MQC) and Liquidated Damages in Container Shipping: Concept and Relevance

- MARPOL (The International Convention for Prevention of Marine Pollution For Ships): The Ultimate Guide

- The Ultimate Shipping Container Dimensions Guide

- A Comprehensive Overview of IMDG Code for Shipping Dangerous Goods

Subscribe To Our Newsletters

By subscribing, you agree to our Privacy Policy and may receive occasional deal communications; you can unsubscribe anytime.