DDP & DDU Shipping Terms Explained

In international commercial transactions, the terms Delivery Duty Paid (DDP) and Delivery Duty Unpaid (DDU) are used to indicate two different types of sales and shipping transactions.

The former is the sale and delivery of goods to the buyer after payment of customs duties – Delivery Duty Paid (DDP) and the latter is the delivery of goods to the buyer at the port of destination without payment of customs duties or taxes.

The abbreviation DDP and DDU come under Incoterms®, terms that are published periodically by the International Chamber of Commerce.

The International Chamber of Commerce (ICC) and Incoterms®

Trading terms known as Incoterms® or International Commercial Terms are used globally in the shipment of commercial cargo.

Where do these terms and abbreviations originate?

They are published by the International Chamber of Commerce (ICC), amended and updated from time to time. Such terms are intended to standardize terms, conditions, and make trade communications easy between different parties operating on a global level.

It helps do away with confusion arising out of different terminologies and usages in trade prevalent in different countries. As such, Incoterms® is recognized internationally by governments, lawyers, trade bodies, and trade councils.

Incoterms® fixes the responsibilities of the seller, the carriage agent, and the buyer. It avoids ambiguity in the wording of agreements.

The latest publication ‘Incoterms® 2020’ was published in 2019.

The abbreviation ‘Incoterms®’ is a registered trademark of the International Chamber of Commerce. Though it is not mandatory for businesses to use Incoterms® in their documents, the ICC has brought in the rule that with effect from January 1, 2020, when using Incoterms®, only Incoterms® 2020 should be used in sales and trading documents.

In case Incoterms® 2010 is used, then, that has to be specified in the concerned documents.

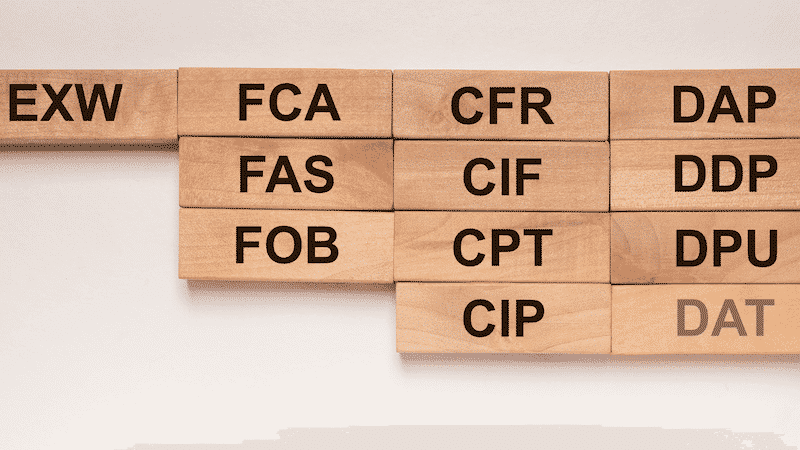

The Seven Rules of Incoterms® 2020

The Incoterms® 2020 has seven rules that cover all modes of transport. These seven rules are:

- EXW – Ex Works (showing the place of delivery)

- FCA – Free Carrier (showing the place of delivery)

- CPT – Carriage Paid to (showing destination)

- CIP – Carriage and Insurance Paid To (showing destination)

- DAP – Delivered at Place (showing destination); replaces Delivered Duty Unpaid or DDU.

- DPU – Delivered at Place Unloaded (showing destination); replaces Delivery at Terminal or DAT.

- DDP – Delivered Duty Paid (showing destination)

Four Incoterms® are specific to water transport and cover sea and inland waterways. They are:

- FAS – Free Alongside Ship (port of loading has to be mentioned)

- FOB – Free on Board (port of loading to be mentioned)

- CFR – Cost and Freight (show port of discharge)

- CIF – Cost Insurance and Freight (port of discharge to be shown)

The ICC holds training and other familiarization events to identify, interpret, and explain the differences between Incoterms® 2010 and Incoterms® 2020. These events cover topics on the roles of the seller, carrier, and buyer in trade, the risks involved, and best practices to be followed.

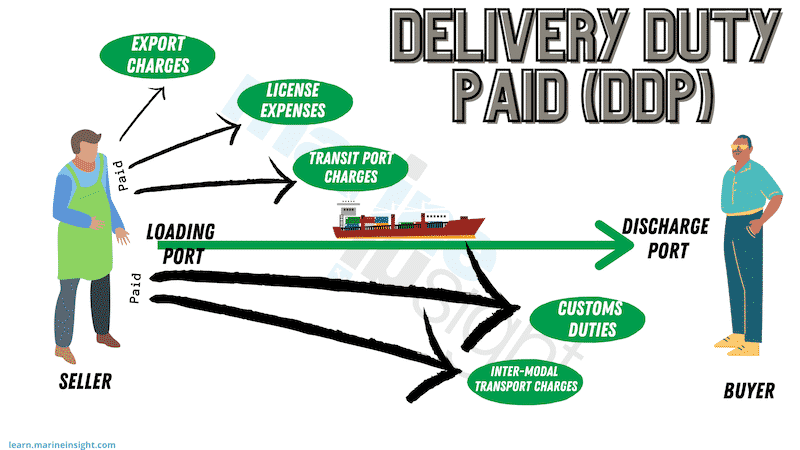

Delivery Duty Paid (DDP)

In export, a seller enters into an agreement with the buyer to ship goods to the buyer’s location overseas. Such agreements would specify the terms and conditions of doing business especially, those who would bear what costs related to the export of cargo.

One very important point of the agreement would be who would be responsible to pay the customs duties and taxes at the destination port.

When it is agreed between the exporter and importer that the former would pay all the customs duties at the destination port, then the agreement of sale or purchase is said to be Delivered Duty Paid (DDP).

The seller undertakes to send goods and deliver to the buyer at an agreed-upon location that could also be the destination port, his warehouse, or premises bearing all expenses, customs duties, and taxes.

The risk on the cargo is usually transferred to the buyer once the goods reach the destination port. The crucial point here is that the buyer and the seller must agree on all points related to the payment and the place or location of delivery beforehand.

In DDP agreements, the seller usually has an agent at the destination port who arranges payment of duties and taxes, any inspection fees, etc. and clears and delivers the cargo as agreed between seller and buyer.

Customs clearance documents and formalities differ between countries and it requires an in-depth knowledge of these formalities, which the local clearing agents will have.

Having a local agent helps to avoid delays in the clearance of cargo on account of incomplete documentation or ignorance of government or customs procedures. When goods are shipped DDP, any damages or loss to the cargo during transit is the responsibility of the seller.

In Delivery Duty Paid, the buyer pays the seller a price that is inclusive of freight, insurance – if applicable, and all customs duties and taxes. It is a consolidated amount that makes it convenient for the buyer in the costing of his goods.

In DDP agreements, it is the seller who bears most of the risks. However, including such a term in the trade agreement could have some disadvantages as well.

Sellers usually include a mark-up on all the expenses that they meet under the heading ‘administrative fees. This results in the cost of the goods going up. Buyers can easily avoid this mark-up by arranging for the clearance and payment of duties and taxes at their end.

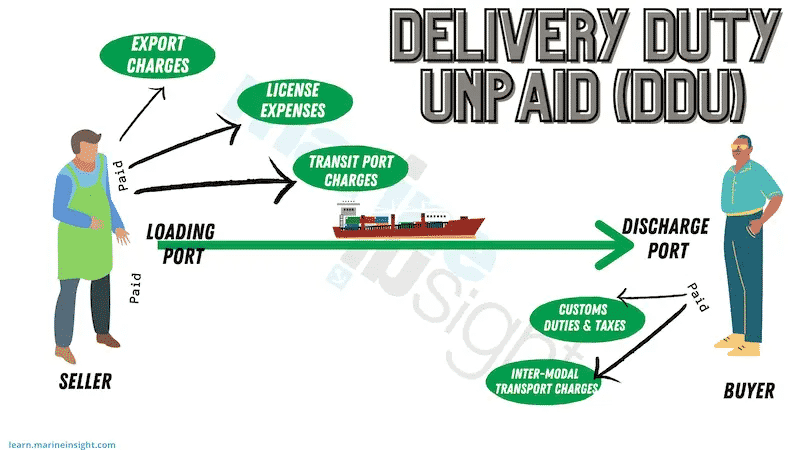

Delivery Duty Unpaid (DDU)

The terms and conditions between the seller and buyer, when they agree to do business, may state that the seller would only be responsible for sending the goods by sea to an agreed-upon location.

However, the seller has to pay for all the export formalities and licenses. This includes expenses at the transit ports if any. In such cases, the buyer or consignee will have to clear the cargo by paying all the applicable customs duties and taxes at the port of discharge.

The seller’s responsibility ends when the goods reach the place agreed. The cargo becomes the buyer’s responsibility once it has reached the specified location.

Such an agreement between the seller and buyer is termed Delivered Duty Unpaid (DDU). The International Chamber of Commerce has replaced the Incoterm DDU with DAP (Delivered at Place) in its latest publication ‘Incoterms® 2020’.

Here, the usage of ‘Delivery’ and ‘Delivered’ mean the same.

When the Incoterms® is Delivered at Place (DAP), when the goods reach the agreed destination, the customer has to be ready for its clearance by payment of customs duty and any other taxes.

Since he will also be responsible for the unloading of cargo and its transportation to his premises, these two factors have to be considered beforehand.

Delivered at Place (DAP) and Delivered at Place Unloaded (DPU)

In ICC’s latest publication ‘Incoterms® 2020’, the term DAP (Delivered at Place) has replaced DDU. Another important term that has been replaced is DAT (Delivered at Terminal). DAT is replaced with DPU (Delivered at Place Unloaded) to specify that the place of unloading can be anywhere and is not restricted to just a terminal.

DAP and DPU are two Incoterms® that are similar to DDU. DAP stands for Delivered at Place and DPU stands for Delivered at Place Unloaded. Under DAP, the buyer takes care of the payment of customs duties and taxes and unloading as well.

The seller arranges for carriage and delivery of goods to a pre-agreed location, ready to be unloaded. DAP can be used in agreements of any mode of transport.

In DPU, the seller is responsible for delivering and unloading the cargo at the place that is specified in the agreement between him and the buyer.

CIF, CFR, CIP

Whether Delivered Duty Paid or Delivered Duty Unpaid, the insurance may or may not be part of the cost. The cost of goods could include cost, insurance, and freight (CIF) or only cost and freight (CFR). Cost and Freight are also shown as C&F. In the case of CFR (or C&F), the insurance is taken by the buyer. The terms CIF and CFR are used in sea freight.

Another incoterm that is similar to the ones mentioned above is Carriage and Insurance Paid To (CIP). Under this agreement, the seller pays for carriage and insurance to a specified location that need not be the final destination of the cargo.

Once the goods reach the specified location and are handed over to the buyer or his appointed agent, the seller’s responsibility for the cargo ceases. Since the seller pays for carriage and insurance only up to a specified location, the buyer will have to make arrangements for the rest of the journey by way of carriage and insurance.

According to Incoterms® 2020, trading under CIP terms requires a higher insurance cover. Like most of the other terms, the term CIP is used with a location name, such as CIP Los Angeles.

Let us look at an example to understand the term CIP further.

Company X in South Korea sells mobile phones to company Y in Dallas, Texas, USA. The incoterm for shipment is CIP Charleston, USA.

Once the vessel with the cargo of mobile phones reaches the Port of Charleston and is handed over to the representative of Company Y, Company X’s obligation is complete.

The movement and responsibility for the goods from Charleston to Dallas now rests on the buyer or Company Y. In this case, Company Y would have already arranged for the trucking of cargo and its insurance from Port Charleston to Dallas.

DDP and DDU (now DAP) are very often confused with CIF, CFR, CIP, etc. To clarify this, these terms are all entirely different.

DDP means that customs duty and taxes at the destination port are paid by the seller. DDU means that the customs duty and taxes at the destination port are paid by the buyer.

CIF is the incoterm used for a trade agreement between the buyer and the seller where the seller agrees to exchange goods with the buyer for a price that includes the cost of goods, its insurance during sea freight, and the sea freight.

CFR (also shown as C&F) is the cost and freight only without including insurance on the goods. When carriage and insurance of the goods are only up to a specified point it is called CIP (Carriage and Insurance Paid To).

As we can see, DDP and DDU are concerned with the payment of customs duties and taxes during the import process whereas CIF, CFR, and CIP are all about the cost of goods, insurance, and sea freight.

The Incoterms® DDP and DDU are also used in conjunction with other Incoterms® such as CIF, CFR, CIP, etc. When the Incoterms® shown in a trade document are CIF DDP it means that the price at which the goods are sold to the customer includes cost, insurance, and freight.

Duties and taxes incurred on the cargo are also paid and taken care of by the seller.

Where are Commercial Incoterms® Shown?

Incoterms® specify the responsibilities of the different parties to a trade agreement – the seller, the carrier, and the buyer. As such, they are normally found on documents such as the commercial invoice, bill of lading, or any other trade document that shows the arrangements between the seller and buyer.

Why is Incoterms® Important?

It is common to find poorly worded or even incomplete trade documents and agreements. When prepared by inexperienced hands, they can even become open-ended.

This leaves scope for pitfalls especially in the event of litigation between the trading parties. Therefore, it is a good practice to show all terms and conditions using the correct Incoterms® on sales and shipping documentation.

Since they are standardized and recognized internationally, it averts confusion and misunderstanding between parties involved in the business and improves communication.

The responsibilities of each party are pre-defined and each one is clear about his role in doing the business. It helps banks to understand the documents they are dealing with, especially when it comes to letters of credit, guarantees, etc.

The buyer who requires a letter of credit from a bank will want the LC (letter of credit) to reflect precisely what is expected of the seller, in terms of documents required and other relevant points in doing business on credit.

You might also like to read:

- What is ETD and ETA in Shipping?

- What is Demurrage and Detention in Shipping?

- Freight Forwarding Process – Everything You Wanted to Know

- NOTIFY PARTY in Shipping – Everything You Wanted To Know

- What Is Consignee And Consignor In Shipping?

- What is Blind and Double-Blind Shipment?

Disclaimer: The authors’ views expressed in this article do not necessarily reflect the views of Marine Insight. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Marine Insight do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader.

The article or images cannot be reproduced, copied, shared or used in any form without the permission of the author and Marine Insight.

Do you have info to share with us ? Suggest a correction

About Author

Hari Menon is a Freelance writer with close to 20 years of professional experience in Logistics, Warehousing, Supply chain, and Contracts administration. An avid fitness freak, and bibliophile, he loves travelling too.

Latest Maritime law Articles You Would Like:

Latest News

- What is the Purpose of DG Shipping?

- What are Logistics Risks?

- How Port and Terminal Operators Can Control Emissions?

- Minimum Quantity Commitment (MQC) and Liquidated Damages in Container Shipping: Concept and Relevance

- MARPOL (The International Convention for Prevention of Marine Pollution For Ships): The Ultimate Guide

- The Ultimate Shipping Container Dimensions Guide

Subscribe To Our Newsletters

By subscribing, you agree to our Privacy Policy and may receive occasional deal communications; you can unsubscribe anytime.