What is Seaway Bill in Shipping?

A seaway bill is a receipt of goods issued by the ocean carrier to the customer (also called the consignor or shipper).

It is a contract by which the ocean carrier undertakes to transport the customer’s cargo in its vessel or vessels, from one point to the other.

It is a non-negotiable contract between the ocean carrier and the customer to deliver the goods booked by the customer to a specific consignee.

It is this non-negotiable nature of the bill that sets it apart from the regular bill of lading.

The seaway bill is usually preferred by companies that deal directly with each other on a regular basis. There is no involvement of a third party in such dealings in which instruments such as bank letter of credit, etc. are not used.

A seaway bill will show a consignor and a single consignee who can receive the goods at the port of discharge.

Both the seaway bill and bill of lading are issued by the carrier to acknowledge receipt of cargo and undertake to transport it from one place to another as per terms and conditions mentioned in the bill.

However, the main difference between a seaway bill and a bill of lading is that while the former is non-negotiable, the latter is negotiable.

When a bill of lading is made to the ‘order of’ a certain party, it means that the ownership of the goods shipped under the document is transferable to a different party.

If the bill of lading is endorsed in the name of another party and the party is in possession of the original endorsed bill, then this party can claim receipt and ownership of the goods.

Negotiable V Non-Negotiable Documents

A negotiable document or instrument allows the holder to transfer the title of ownership of goods to a third party. Normally, there are two parties to such a transfer – the endorser and the endorsee.

The original bill of lading can change hands through endorsement whereby the endorser (the original owner of the cargo) transfers ownership of cargo to the endorsee (the new owner of the cargo as agreed between both the parties).

The cargo is shipped and delivered to the party who holds the original, endorsed bill of lading.

A non-negotiable instrument specifies a single party as the owner and this ownership cannot be endorsed to a third party. The cargo, in this case, is shipped to the originally specified party.

An endorsement to be valid must be signed by the endorser or holder either on the face of the bill or its back-side. The transaction is said to be complete when the instrument is delivered to the endorsee in whose name the ownership has been transferred.

Issuing the Seaway Bill

A seaway bill is usually issued in triplicate – the original and second copies are given to the shipper or consignor, and the third to the consignee. The consignor sends the original to the consignee for clearance and receipt of the cargo into his warehouse.

A seaway bill is a non-negotiable instrument that facilitates easy and fast clearance of goods through telex release or expresses release.

Telex Release

Sometimes the shipper and customer may agree to do away with the practice of exchanging the original bill to facilitate timely clearance and receipt.

Instead, the shipper will surrender the original bill to the ocean carrier or his appointed agent at origin. When it is surrendered, the carrier will send an electronic message confirming this to their office at the destination port.

Once the vessel reaches its destination port and the cargo that is mentioned in the bill is offloaded, the goods will be handed over to the consignee, after verification of the consignee’s identity, etc.

It is normal practice for the shipper to send the customer a confirmation message on the surrender of the original seaway bill. This method is called Telex Release.

An ocean carrier will need all the original copies of the seaway bill to be surrendered at their office. The clearing agent at the destination only has to contact the carrier’s office at the destination with the necessary credentials and documentation to get details of the cargo and its clearance.

An advantage of the telex release is that cargo will be released at the destination port without having to produce the original seaway bill as they are already surrendered at the port of origin.

It, therefore, avoids delays that can happen in the exchange of original documents and subsequent clearance of goods. All that the consignee has to do is to clear Customs, pay all dues to the concerned parties, and take charge of the consignment.

The term ‘telex release’ has stuck on to date even though the message to release cargo without the original bill is conveyed through email or by other electronic means. Earlier this message was conveyed by sending a telex message.

Express Release

In an Express Release, the carrier, after completion of the necessary paperwork and other formalities produces an electronic bill of lading called the Express Bill of Lading. An electronic copy is given to the shipper.

There is no other physical document in this kind of bill of lading and this is all that is required for the consignee to clear the goods once the carrier offloads cargo at his end.

The customer has to just establish his credentials at the carrier’s office. There is no OBL (original bill of lading) when it comes to an express release.

Telex and express release save time and money. An original bill of lading may be lost or delayed in transit. The vessel carrying the cargo might have already reached the discharge port by this time and if it is not cleared within the stipulated period it could lead to storage or demurrage charges – both from the port as well as the ocean carrier.

Telex and express release is mostly used with seaway bills. In other words, these two methods of releasing cargo to the consignee do not work with bills of ladings that are negotiable documents.

There may be exceptions to this whereby, when a telex or express release is requested of a bill of lading, it loses its ‘negotiable document’ status. In such cases, the consignment is delivered only to the consignee named in the bill of lading and cannot be endorsed to another party.

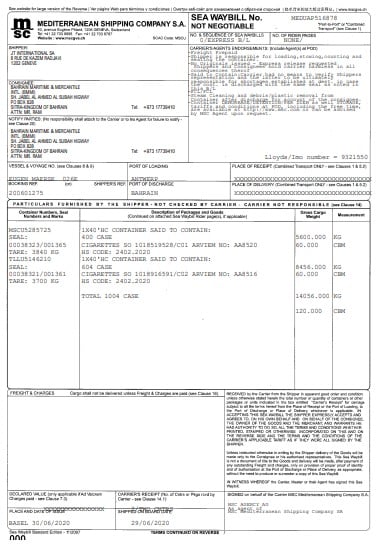

Contents of a Seaway Bill

What does the seaway bill show? The answer to this is simple; pretty much everything that is shown on a bill of lading.

However, a key difference between the two is that a seaway bill will always be titled ‘SEAWAY BILL NON-NEGOTIABLE’.

A seaway bill typically shows the following details, each in their separate fields:

Seaway Bill Number

This is a unique alphanumeric identification code issued by the ocean carrier for identification of the consignment and which is usually quoted on all correspondence related to the shipment.

Consignor

The consignor field shows the name and address of the party who ships the goods through the ocean carrier to his customer. The consignor is the shipper or exporter sending goods and as such, this field may also be labelled as ‘shipper’ or ‘exporter’.

Consignee

In a seaway bill, the consignee is the consignor’s customer. It is the party who receives goods at the port of destination, through his clearing agent, after payment of all customs duties and other dues. The consignor, having sold or transferred the goods to the consignee, cannot change hands further through endorsements or other means.

In a seaway bill, this field is usually left blank as the consignee is the party that is to be notified upon arrival of the vessel at the destination. Some shipping companies may enter the same address as shown under the ‘consignee’, in this field.

Vessel Name and Voyage Number

The name of the vessel on board which the consignment is loaded is shown here. If the vessel has a voyage number, that will be mentioned alongside the vessel name.

Place of receipt

The place of receipt is the location where the goods are handed over to the ocean carrier by the shipper (consignor), which is usually the port of loading. The goods may also have been handed over to the carrier or its agent from a different location, other than the load port.

Port of Loading

Port of loading is the port from where goods are loaded on board the ocean vessel.

Port of Discharge

The port of discharge is the destination port of the cargo where the goods are off-loaded from the vessel for delivery to or collection by the customer (consignee).

Place of Delivery

When the ocean carrier is contracted to deliver the consignment to the address of the customer or an alternative storage location, that is shown under ‘Place of Delivery’. In such cases, the carrier’s office will make arrangements to transport the cargo overland or by other means to the specified place of delivery. The consignee takes delivery of his goods from this location.

Booking ref./ Shipping ref.

The shipping company may have their booking reference or shipping reference numbers. If these are available, these numbers are shown under this field.

Cargo description /Dimensions /Container details

The details shown above is followed by a table that shows the unique container number (or numbers) and the seal numbers. The description of packages and the goods contained therein with the total number of packages are shown in this table. It also contains the gross cargo weight and measurements. These are normally shown in kilograms (KG) and cubic meters (CBM).

International Maritime Organization and Lloyds Register Numbers

Another important number shown on a seaway bill is the IMO (International Maritime Organization) or the Lloyds Register number.

The IMO number is a unique and permanent number that identifies the ship. A unique seven digits number is preceded by the letters IMO (example IMO1234567). This number does not change irrespective of changes to the ship’s owner, flag, or name.

A specialized wing of the United Nations, the IMO is responsible for regulating shipping activities worldwide that include their safety and security.

One of the main tasks of Lloyds Register is the classification of marine vessels. Based in London, it has other business interests that stretch into engineering and technical fields. The Lloyds online register includes information on marine vessels besides other assets that have been classed by the Lloyds Register.

Other Fields on the Seaway Bill

Carrier Endorsements

A seaway bill may include endorsements regarding the mode of freight payment, whether telex or express release, etc. This field will show the ocean carrier agent’s endorsements, both at the port of loading as well as discharge.

It is also common to find details of cargo insurance, inland routing instructions – if any, and such other details in the seaway bill.

Shipped on Board Date

As the heading specifies, this is the date when the goods are taken on board the carrier.

Declared Value of Goods

The declared value of goods is the value as shown on the invoice by the shipper. This value is used for computation of customs duty or any other taxes that may be applicable in the normal course. The ‘declared value’ may or may not be printed on the seaway bill.

Place and Date of Issue

The seaway bill is usually issued from the ocean carrier’s office. It is signed and issued to the shipper or his agent. The place from where it is issued will be shown on the seaway bill.

The date on which the seaway bill is prepared and released to the shipper or his agent is the ‘date of issue’.

Signature

The signature field is normally the last field on the seaway bill. This holds the signature of the ocean carrier’s authorized signatory. It formally binds him as the carrier of cargo as mentioned in the seaway bill. These days most bills do not carry signatures as they are generated digitally.

Disadvantages of a Seaway Bill

Upon issue of a seaway bill, the consignee shown on the bill cannot be changed and goods will only be delivered by the ocean carrier to the specified consignee. Therefore, the seaway bill cannot be used as a negotiable document.

Banks and financial institutions do not accept seaway bills from companies to issue financial guarantees as it does not give them control over the title of goods. On the other hand, bills of lading, because of their negotiable nature, are accepted by such organizations to issue letters of guarantee (letter of credit).

You Might Also Like To Read:

- Container Seals; Importance, Types, And Requirements

- What is Non-Vessel Operating Common Carrier (NVOCC)?

- Voyage Charter vs Time Charter

- What is Blind and Double-Blind Shipment?

Disclaimer: The authors’ views expressed in this article do not necessarily reflect the views of Marine Insight. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Marine Insight do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader.

The article or images cannot be reproduced, copied, shared or used in any form without the permission of the author and Marine Insight.

Do you have info to share with us ? Suggest a correction

About Author

Hari Menon is a Freelance writer with close to 20 years of professional experience in Logistics, Warehousing, Supply chain, and Contracts administration. An avid fitness freak, and bibliophile, he loves travelling too.

Latest Maritime law Articles You Would Like:

Latest News

- What is the Purpose of DG Shipping?

- What are Logistics Risks?

- How Port and Terminal Operators Can Control Emissions?

- Minimum Quantity Commitment (MQC) and Liquidated Damages in Container Shipping: Concept and Relevance

- MARPOL (The International Convention for Prevention of Marine Pollution For Ships): The Ultimate Guide

- The Ultimate Shipping Container Dimensions Guide

Subscribe To Our Newsletters

By subscribing, you agree to our Privacy Policy and may receive occasional deal communications; you can unsubscribe anytime.

Even though the article is good but the words keep getting changed in every para….consignor then it becomes shipper etc etc.. Would have been better if same words were used in all the para

good article

Glad you liked it Chris 👍

@Vishal: Noted the pointers. Thank you for commenting .