Latest Articles

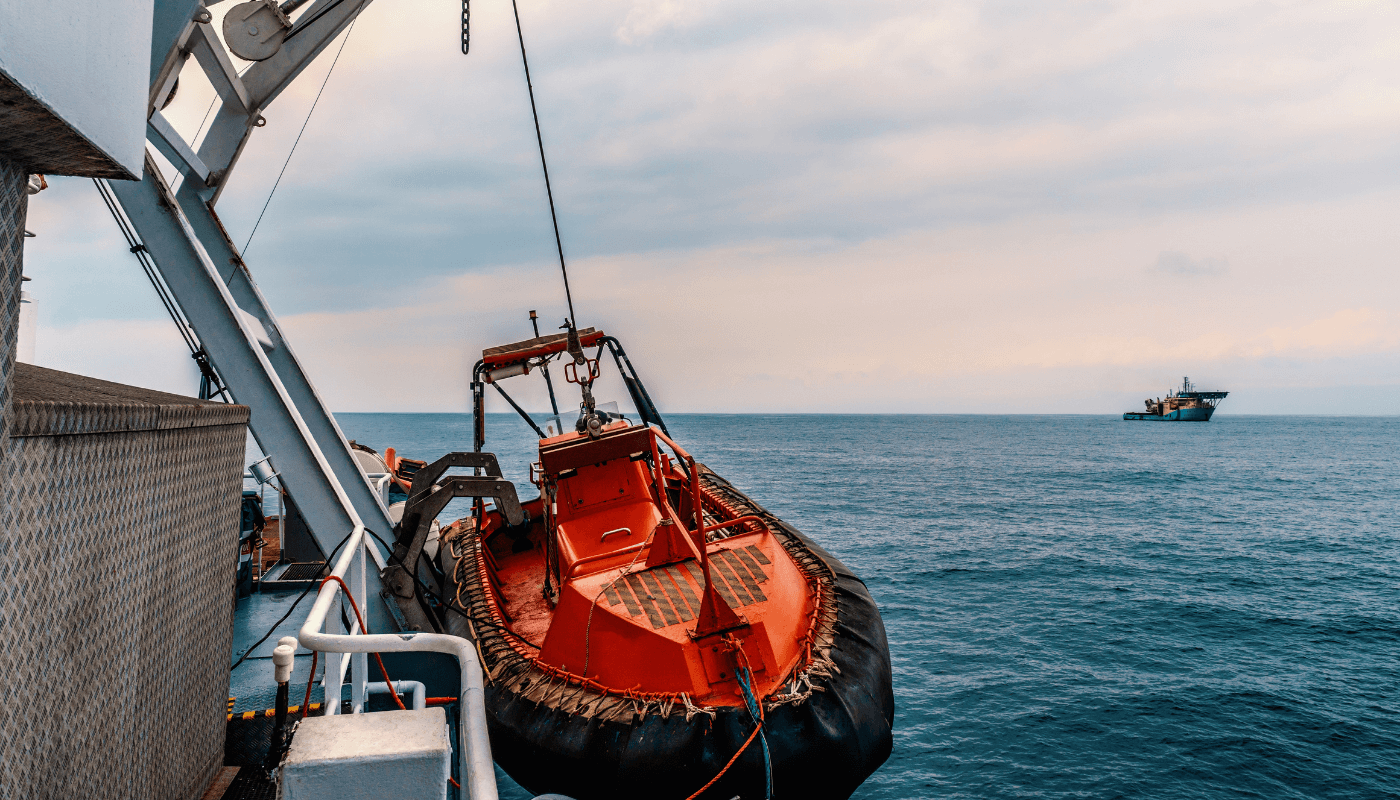

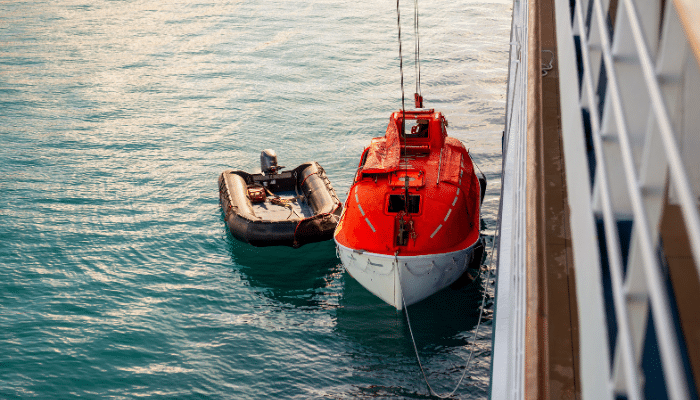

What are Fast Rescue Boats?

What are Logistics Risks?

A Guide To IMU CET Exam 2024

How Port and Terminal Operators Can Control Emissions?

Top 15 Biggest Aircraft Carriers in the World

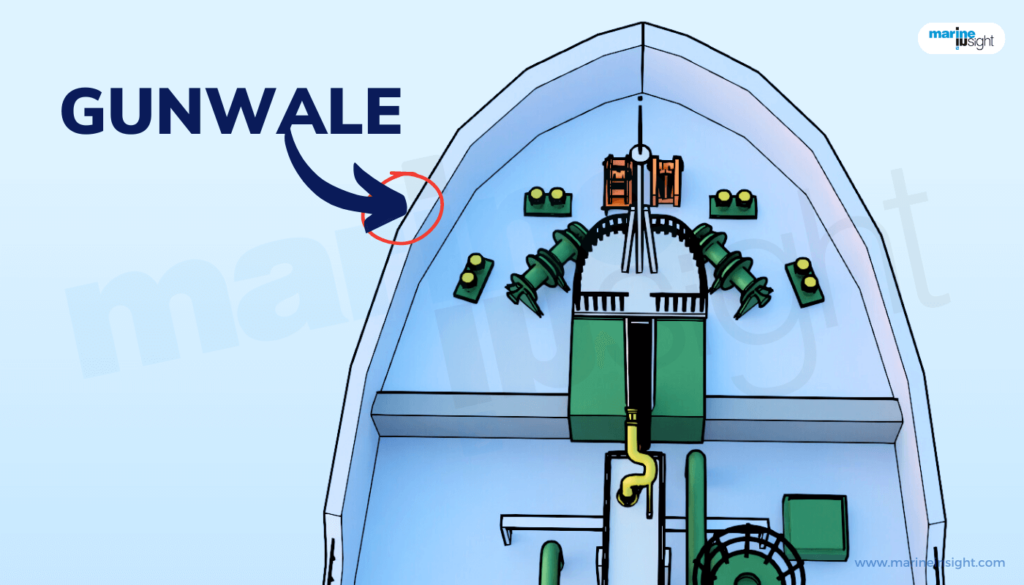

What is Gunwale of a Boat or Ship?

Maritime Law & Logistics

A Comprehensive Overview of IMDG Code for Shipping Dangerous Goods

Nautical Law: What is UNCLOS?

Read More From This Category >