Hapag Lloyd Improves Operating Result Significantly For 2018

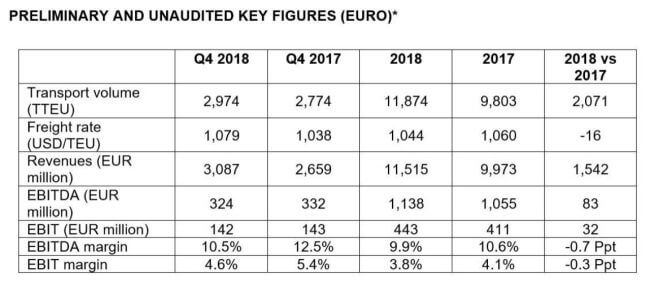

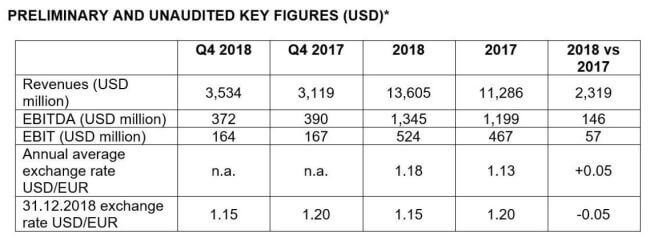

On the basis of preliminary and unaudited figures, earnings before interest, taxes, depreciation and amortisation (EBITDA) rose to EUR 1,138 million (2017: EUR 1,055 million). Earnings before interest and taxes (EBIT) rose to EUR 443 million (2017: EUR 411 million).

Both figures are at the upper end of the ranges forecast for the 2018 full financial year (EBITDA: EUR 900 to 1,150 million; EBIT: EUR 200 to 450 million), which Hapag-Lloyd announced on 29 June 2018. The main drivers are higher global transport volumes, steadily improving freight rates in the second half of the year, the merger with United Arab Shipping Company Ltd. (UASC), and the resulting cost synergies.

For the fourth quarter of 2018, the EBITDA of EUR 324 million (Q4 2017: EUR 332 million) and the EBIT of EUR 142 million (Q4 2017: EUR 143 million) were nearly at their prior-year levels.

Revenues increased in the 2018 financial year by 15 percent, to EUR 11.5 billion (2017: EUR 10.0 billion), in particular due to the merger with UASC and the associated 21 percent increase in transport volume, to 11.9 million TEU (2017: 9.8 million TEU). Transport expenses were primarily driven by strong volume growth and a significantly higher average bunker consumption price of 421 USD/tonne (2017: 318 USD/tonne), increasing by 18 percent, to EUR 9.4 billion (2017: EUR 8.0 billion), proportionally less than transport volume. At 1,044 USD/TEU, the average freight rate for the year as a whole was below the prior-year level (2017: 1,060 USD/TEU), with a better fourth quarter at 1,079 USD/TEU (Q4/17: 1,038 USD/TEU). On a pro forma basis and when compared to the combined business of Hapag-Lloyd and UASC for the full year 2017, the transport volume is up 6 percent and the average freight rate is up 2 percent.

All results are preliminary. The consolidated financial statements and the 2018 Annual Report will be published on 22 March 2019.

UASC Ltd. and its subsidiaries have been incorporated into the consolidated financial statements of Hapag-Lloyd since 24 May 2017, the date of transfer of control. As a result, the presented figures include the effects of the transaction and combined business activities from this time on and the 2018 financial year (with UASC) can therefore only be compared to a limited extent with the figures for 2017 (with UASC since 24 May 2017). The cash flows, income and expenses of the acquired UASC Group were translated at the average US dollar/euro exchange rate between 24 May and 31 December 2017 of 1.1687.

Reference: hapag-lloyd.com

Disclaimer :

The information contained in this website is for general information purposes only. While we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Disclaimer :

The information contained in this website is for general information purposes only. While we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Do you have info to share with us ? Suggest a correction

About Author

Marine Insight News Network is a premier source for up-to-date, comprehensive, and insightful coverage of the maritime industry. Dedicated to offering the latest news, trends, and analyses in shipping, marine technology, regulations, and global maritime affairs, Marine Insight News Network prides itself on delivering accurate, engaging, and relevant information.

About Author

Marine Insight News Network is a premier source for up-to-date, comprehensive, and insightful coverage of the maritime industry. Dedicated to offering the latest news, trends, and analyses in shipping, marine technology, regulations, and global maritime affairs, Marine Insight News Network prides itself on delivering accurate, engaging, and relevant information.

Latest Shipping News Articles You Would Like:

Subscribe To Our Newsletters

By subscribing, you agree to our Privacy Policy and may receive occasional deal communications; you can unsubscribe anytime.