7 Secrets Seafarers Should Know About Mutual Funds

This is the seventh article in the personal financial planning for seafarers series by the very experienced Chief Engineer Rajeeve Kaushik. You can read the previous articles of the series here – Importance of Financial Planning for Seafarers , 10 Common Financial Mistakes Seafarers Make , Little Know Facts About Magic Of Savings Seafarers Should Know , 4 Types of Investments That Kill Seafarers’ Hard Earned Money , Insurance- What Seafarers Must Know Before Purchasing, Savings and Investments For Seafarers – Getting Started

Before starting I wish to inform seafarers that it is important for them to understand the concepts of financial planning not only to know where the money is going when they save or invest in a particular avenue but also to prevent themselves from getting distracted by colleagues or various sales personnel.

In this context and very much relevant is the world of MUTUAL FUNDS.

Why am I calling it a SECRET? Because that is exactly the way most of the finance related people are treating this avenue. By far this avenue is the most well controlled, diversified and risk adjusted. Most of the pension funds are run on this basis, but very little information was shared openly. The whole business of PMS (Portfolio Management Schemes) would collapse if everyone started investing through MFs

Let us first know WHAT is a MUTUAL FUND?

It is simply a collection of a people pooling their money together with a company which in turn buys from the market securities in keeping with the philosophy already laid and spelled out.

Broadly MUTUAL FUNDS are of two types:

1. DEBT MUTUAL FUNDS

2. EQUITY MUTUAL FUND

Debt Mutual Fund (also called FIXED RETURN FUNDS) loan the money to the Government of the country and Companies. Since this loan is given at a fixed rate of interest – whatever is the rise in value of that loan instrument- it is reflected in the price of ONE UNIT of that MF which is called NAV.

EQUITY MUTUAL FUND invests the money that it collects, in shares or stocks of companies and whatever is the profit on the shares everyday is reflected in the price of that MF (mutual fund). This price is also called NAV (or NET ASSET VALUE).

Debt MFs are of a lot of types and require some knowledge before investing. In India these type of funds have lost some attractiveness because they are now taxed like bank deposits. In due course I will familiarize you with those that are most relevant to us as seafarers. e.g. in the 3rd article I introduced you to LIQUID FUNDS , which are also type of Debt Funds.

Equity Funds are the ones that should be of most interest to us, because they are the ones that will enable our income to grow over a long time (even as much as 20 years). As I said earlier, once a company called AMC (or ASSET MANAGEMENT COMPANY) proposes to form a particular type of fund it will advertise and collect money from the people and then issue units of a certain face value (mostly INR10 or $10 in other countries).

With that money now this AMC will proceed to buy shares of companies of different sectors e.g. Finance, Technology,Petro,Auto,Engineering etc. Now as the country progresses these companies will also grow and so will their share prices. This will automatically reflect in the NAV of the fund which will start growing up from Rs.10 or $10 steadily. Of course it will fall too, whenever the market will fall due to thousands of reasons- but there are reasons that will keep discussing and you will keep asking – because of which the NAV will definitely rise over the long horizon of 5 to 10 to 20 years. e.g. a Fund called HDFC Equity Fund in India was started in Jan 1995 and the units were issued for Rs.10. After 20 years the NAV of this fund has grown to Rs.490. Even if you calculate in US$ terms and taking into account the depreciation of the Indian Rupee, the fund has grown by almost 160 times or 16000%.

This is what I meant as COMPOUNDING in the 4th article.

Now the question that you must ask is that if a fund has collected money in a particular year or at a particular time when you were at sea how will you benefit. It is a very intelligent question and must be answered.

Most of the funds are OPEN ENDED funds which means that they never expire or mature. After the fund is started initially by collecting money and issuing UNITS at the initial NAV of Rs.10 or $10, it will again REOPEN to collect more money from the same or different investors. This process will be an ongoing process and you can buy more units everyday, everyweek or every month. Of course the price or NAV at which you will get the units will be different every time because of the value of the fund. This is the basic advantage of investing regularly over a long period of time.

In future, I will suggest strategies by which, you will be able to continue investing regularly every week or every month even when you are at sea and have no access to the net facilities or when at leave when you are not getting any salary. But first we must discuss WHY is it necessary to invest in regular steps, THAN as a lump sum.

For example you have 3 lacs (3,00,000 rupees) to invest and you have invested all of them at one go in 1 or more than one funds.

Since the Equity funds are dependent on the share market which is changing everyday; it may so happen that after you by the market starts going down and keeps going down for the next 6 months or one year (this is called a Bear Market run). Now you will start feeling insecure and with everyone around you telling you about doomsday, you might panic and sell off your investment of Rs.3,00,000 at a loss at say Rs. 50,000 . After this you will never look at the MFs or share market again.

Now let us see this situation in numbers:

e.g.On 1st Jan 201X at a NAV of Rs.20 number of units bought = 3,00,000/ 20=15,000 units.

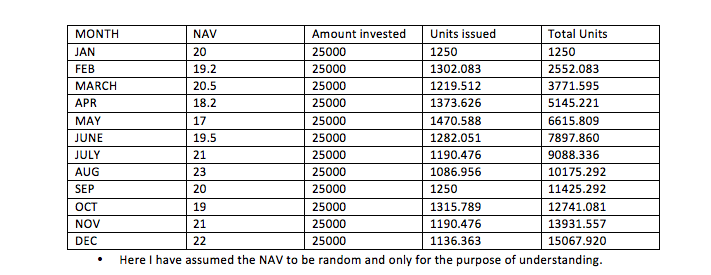

Now let us take an example that you decided to invest Rs.25,000 every Month, since the NAV is daily changing with the market it will look something like this

As you can see by spreading your investment to 12 steps you have gained 150067.920-15000= 67.920 units. If you sold on the last day of Dec, you would have gained 67.920*22= 1494.24.

This is called SYSTEMATIC INVESTING and in a volatile market it works best towards the advantage of the investor. In a favourable situation the difference in returns from a SYSTEMATIC INVESTMENT and a DIRECT one timeinvestment can be as much as double. However there are more advantages that are hidden:

- Ready availability of your money: The funds that are still not invested are available to you in a useable liquid form. Even though the money that you have invested in Equity MFs are quite liquid , but let us assume after your buying the market starts going down so you do not have to really sell because you have no other money left for consumption.

- Market going down works in your favour: This is the best part; that makes you happy when everyone is crying doomsday. When you buy MFs during a going down market, you get more units for the same money when the market moves down. Since you have not invested full money at one go, you are the king during a market going down.

- Peace of mind at all times: Since you still have money with you for investment, you are not in a state of anxiety because the market is going down. Remember everything that goes down has to come up, but by then you should have bought at low prices.

- Ease of Investment: You do not need to open any demat accounts (even though if you have a DEMAT account you can buy through the demat route). After your KYC is done, you can start investing.

- Ease of record keeping: You do not have to keep a track of 20 stocks or research into them before buying. There is no need to keep any paperwork, since there are foolproof record-keeping. Also there are established ways of knowing your latest value of the fund everyday.

- Ease of Selection: It is much easier to select a MF on the basis of its various characteristics. Unlike DIRECT STOCKS, where you need a lot of expertise in selection of stocks. In case of a MF by buying into a DIVERSIFIED EQUITY MF you buy into 30-50 companies which you may otherwise find difficult to do. This feature of the MFs is their greatest advantage which cannot be outperformed by the best of advisors.

- Professional Management: For a small management charges which are not evident to you but are paid out of the corpus, you get the best service and advice from the Best Professionals in the industry.

SO with all these things in mind you can prepare yourselves to invest in MFs for a very very long term. It is this class of investments that will ensure that your money grows against all odds and stands you in good stead.

However out of my experience I have developed few steps which ideally must be adhered to and my colleagues who follow my advice call it the SEVEN GOLDEN RULES:

- NEVER INVEST IN A NFO (New Fund Offer): This is first rule and it means that you must never invest in a new MF which is being offered to you for Rs.10 or $10.This is because at this stage the AMC has not purchased anything and has no assets.

- INVEST IN A GOOD TRACK RECORD: The fund that you invest must ideally be at least 5 years old. Even if the fund has not been a top performer, if it has managed to be in the Top Quartile (Top 25% of the funds), it is sufficient.

- INVEST IN A DIVERSIFIED EQUITY FUND AND NOT SECTOR FUNDS: This means that the fund that you invest in must have a selection of companies that cover the entire economy. Do not try to invest in Funds dedicated to Banking, Petro, Finance alone. The reason being that if at a particular time due to some Geo Political reason a particular industry suffers (like shipping and oil at this time), you may suffer long term losses. A well diversified fund will have a selection from all sectors of the economy which will try to balance each other during any adverse economic situation, giving you a median return.

- APPLY AS AN EXPATRIATE or NRI : This is specially applicable to us, the seafarers because by this mode you will be able to take your money out of the country in case you wish to pursue your higher education outside the country, take your competency exams in UK, Singapore etc.or even at a later stage wish to take up a Shore Job in some country. In Russia you are allowed to invest in MFs in USD itself. This is not possible in Sri Lanka, Philippines and India where you have to invest in the local currency. This is the best feature of MFs. In India this will be possible only if you invest it out of your NRE account.

- FILL UP THE APPLICATION FORM CORRECTLY: This looks easy but you will be surprised how many people never fill up the form on their own and the MF advisor/agent skips details like email address, Phone No. or the correct bank account type. The email address and mobile no. will enable you to get record of each transaction. In India simply by mentioning the email address, it is possible to download the entire portfolio of MFs however old it maybe- in a single page.

- OPT FOR DIRECT CREDIT TO BANK (DCB) MODE: This means that when you sell or REDEEM your fund or part of it, the proceeds will be sent directly to your bank account and not by cheque to home address. This will not only ensure faster receipt of your money even if you are at Sea and no one is at home. In today’s times and especially for seafarers this is a very safe mode since you can do the selling while on board.

- OPT FOR SECOND APPLICANT/NOMINATION: This is true for most of the financial products and bank accounts. With a life as risky as ours, it will only be helpful that our survivors whom we NOMINATE get the funds in case of a mishap. A SECOND APPLICANT will ensure that any paper work if required can be done while you are at sea. Apply on Either OR Survivor basis.

As you can see at this stage itself , that MFs provide you with a well intentioned, risk diversified and simple method of investment. Now our job is to understand and find the information about investing in MFs. We have to shortlist certain No. of funds to suit our requirements and also develop strategies for investing so as to extract maximum out of our earnings.

This we will do in our next article. SO far there is some homework that I wish that you do.

First, read all the previous 6 articles, which have led us to Mutual Funds as the convenient and preferred means of investment.

Secondly, for your respective countries try to search for Equity Mutual Funds through “ Google”. E.g. type Mutual Funds in Philippines, or Sri Lanka, India etc. This will prove to be the most valuable and profitable search that you ever made since the times of Columbus.

HAPPY LEARNING and HAPPY INVESTING

Disclaimer: Author is a Chief Engineer from the Merchant Navy and has no formal qualification in Financial Planning. Views expressed are based on his own experience and that of others who have benefitted with his help. He may be reached at the forums. The author and Marine Insight shall not warrant or assume any legal liability or responsibility for the accuracy, completeness or usefulness of any information provided herein

Are You A Seafarer Looking For Sound Advice On Financial Planning? Ask The Expert

CLICK HERE TO ASK QUESTION

Latest Financial Planning You Would Like:

Do you have info to share with us ? Suggest a correction

Related Posts

Subscribe To Our Newsletters

By subscribing, you agree to our Privacy Policy and may receive occasional deal communications; you can unsubscribe anytime.

Web Stories

About Author

Rajeeve has been a Chief Engineer for 19 years. He kept his deadline and retired himself on his 50th birthday. With a penchant for reading and writing serious literature and driving long distances, his main hobby is observing and commenting on the economy of the country. He has been helping colleagues at sea by planning their finances and future for over 20 years now. Living in the rapidly diminishing Himalayas, he appreciates every aspect of his beloved country, lying between the Green Hills and the Blue Ocean.

first of all, i completely disagree with Rajeeve regarding what he has mentioned :

1. MFs are all subject to market risks and are entirely market dependent, ofcourse when markets crash the nav values are not so badly affected proportional to the crash value they do give you a time to get out, but the question is how. Being in the middle of the atlantic inside soup of a storm it is impossible to redeem your precious investments.(unless you have pre-signed a redemption receipt and submitted to your broker before joining and that too the signature does not get rejected)

2. MF cos invest your Rs.100 and make 70 bucks out of it and give you max 10 to 5 bucks rest is their pockets minus their salaries and your account maintenance.

3. Ofcourse they are highly regulated bodies, but lack transperency meaning in the middle of the ocean i do not know what is the fund manager doing during his office hours with his female colleagues.

4. SIP is a complete farce and rip off in a bull market, meaning if the market is rising with a SIP calculate what units you will get instead of a one shot investment. Yes SIP is great in bear market. But can you predict who is out there a bear or bull ? and by the way SIP is difficult to stop it takes more than a month to stop it.

5. MF cos are currently playing only in the equity and debt segment, not in derivatives, commodities etc

6. I feel it is better to invest directly in the stock through a reputed investment firm rather than purchasing MFs

Well BB, as it is obvious that you are well equipped with the knowledge of financial markets, and are quite successful at it.

The article is for the people who know less or nothing about the markets and those who are unable to pick stocks like you do .

So enjoy the articles if you can.

Thanks a lot Rajeeve for the highly informative post. We are sure many readers will find it beneficial. Looking forward to the next one..

Thanx sir for the informative post.

I had couple of doubts. Can an NRI invest in MF through the same route as that of a resident or there is some different process for NRIs. Some times when seatime is less then the status changes from NRI to residents. What to do in that case.

Pls also throw some light on PIS

FOR ASHISH:

Sorry Ashish , had overlooked your mail, since the comments are normally arranged by the editors to be put in the Forums.

As I have mentioned in my & secrets; you can invest in MFs in the same way as a resident will.

The only difference is that while filling in the form apply as a NRI instead of as a Individual.

You can invest from your NRE account, in which case you have o tick the REPATRIABLE column on the form.

OR

If you are investing from your NRO account you will have no choice except to tick the NON-REPATRIABLE column on the form.

Since we have a special status for a NRI, as in we leave the country FOR employment as against the normal NRIs who visit the country while on leave.

If for a certain F.Y you do not retain the NRI status, you need not change the status of your MFs or the bank account as in the succeeding year you may again be a NRI.

However the interest on your bank accounts will become taxable.

Whereas there is no special tax treatment for MFs when you temporarily or otherwise become a resident, since for a NRI any capital gains incurred on Equity or Debt funds is always DEDUCED AT SOURCE.

This tax may be claimed by filing your tax return (which I advise must be filed even if you are not in the taxable range).

Being on the right side of the law is another advantage of MFs for us, The Seafarers.

Dear Sir, Mr Kaushik….

Thanks for excellent articles. I m also ce in a HK based company……i bought my own house …hv abt 50L land and invested in abt 1.5cr in mutual funds and some cash as fds…Pls advised am i on right track.

My expenses are 50k/per month and want to retire at 50 i.e another 3 yrs.

Can you pls tell me am i on track for financial freedom and can i afford to retire. I hv two kids in cls12 and 10.

Dear Sir,

Mr. Rajeeve is answering all questions at the forums

It would be great if you make a new thread under >> https://forums.marineinsight.com/forum/main-forum

Can you please re-post your question there?

Thanks a lot in advance.

Regards,

Raunek

Thanks for sharing such a wonderful piece of information about mutual fund.

?

Nice piece of Information! It’s a great blog about 7 secrets seafarers should know about mutual funds.

One of the best mutual funds guide available online. Thanks for sharing.

@Yogesh: Glad it is useful. Credit goes to the author- Mr. Rajeev Kaushik.